Last week on the blog I wrote about the importance of a CRM tool for your WooCommerce store. I also shared my animus towards the overuse of acronyms in a business context; they often are much less complicated than meets the ear.

This has inspired me to start a new segment on the blog where I explore a new businesses/eCommerce acronym every post; an Acronym Academy of sorts.

The goal is here simple; breakdown business acronyms to help you to understand and use them in your business analysis.

Intro over, let's jump in.

Acronym Overview

Acronym: LTV (sometimes known as A.R.P.U)

Stands for: Lifetime Value (sometimes known as Average Revenue Per User)

Formula: (Total Gross Orders - Total Refunds)/Customers

Complexity: Medium

Topline

Customer LTV, or just LTV for short, is a valuable metric for understanding how much a customer is actually worth to your business.

In short, LTV will tell you how much dollar value you should expect from every new customer. This get's even more interesting and valuable when you start to breakdown your customers into segments and derive a different LTV per segment. For example, is there a difference in the LTV of a domestic customer vs. international customer? What about a registered user vs. a guest? This is going to help you determine how you should allocate your customer acquisition budget to maximize profits.

A quick note on the formula used to calculate LTV. A quick Google search will show you that there are many ways to calculate LTV — many of them factor in the expected lifetime of a customer into the equation. This type of LTV formula is useful for stores that sell subscriptions, where you have a better grasp on customer retention. This is less helpful for stores that sell one-off products, as it's much harder to measure the expected lifetime of a customer. As such, in Metorik, LTV in our non-subscription reports is calculated using the formula the simple LTV formula:

(Total Gross Orders - Total Refunds)/Customers

This makes LTV in non-subscription reports equal to A.R.P.U (average revenue per user).

Going deeper

So let's look at how you can calculate LTV for your store.

Example 1: LTV across all your customers.

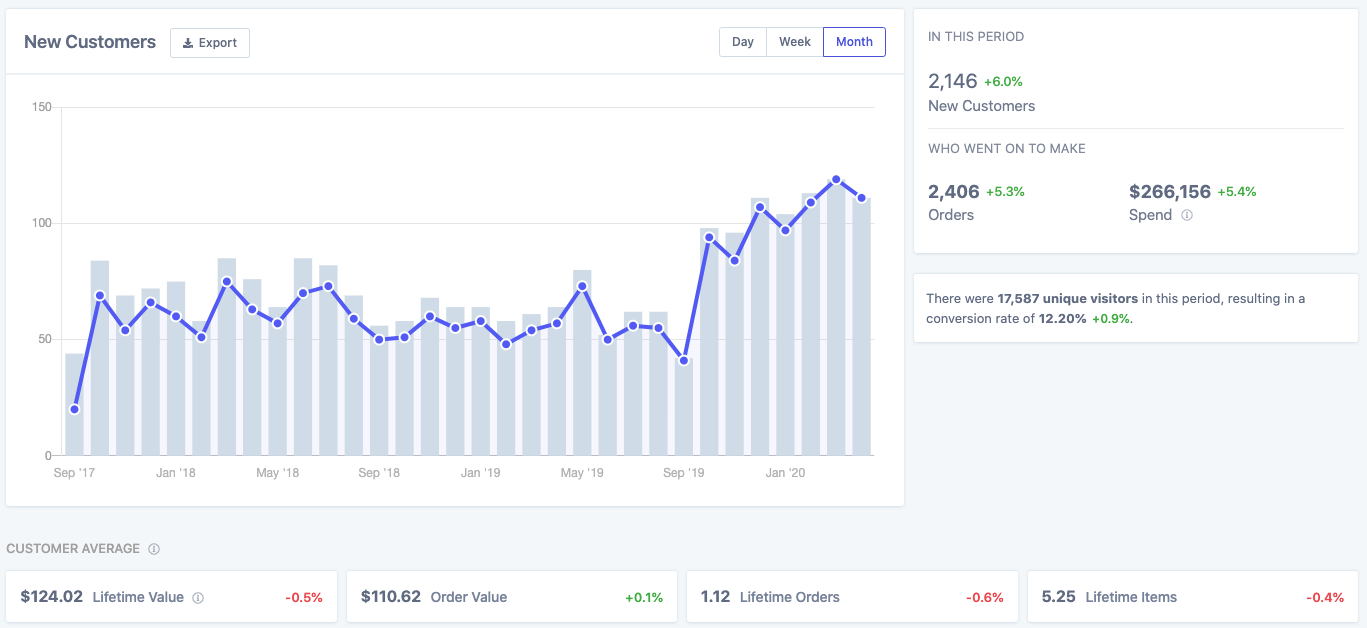

Over your store's lifetime, you had revenue of $266,156. That revenue came from 2,146 customers.

To calculate LTV, take all of the revenue that period (for this example it's the lifetime of the store) and divide it by the number of customers that made orders in that period.

LTV = 266156/2146 = $124.

In Metorik, you can find this in the customers reports :

Example 2: Segmented LTV

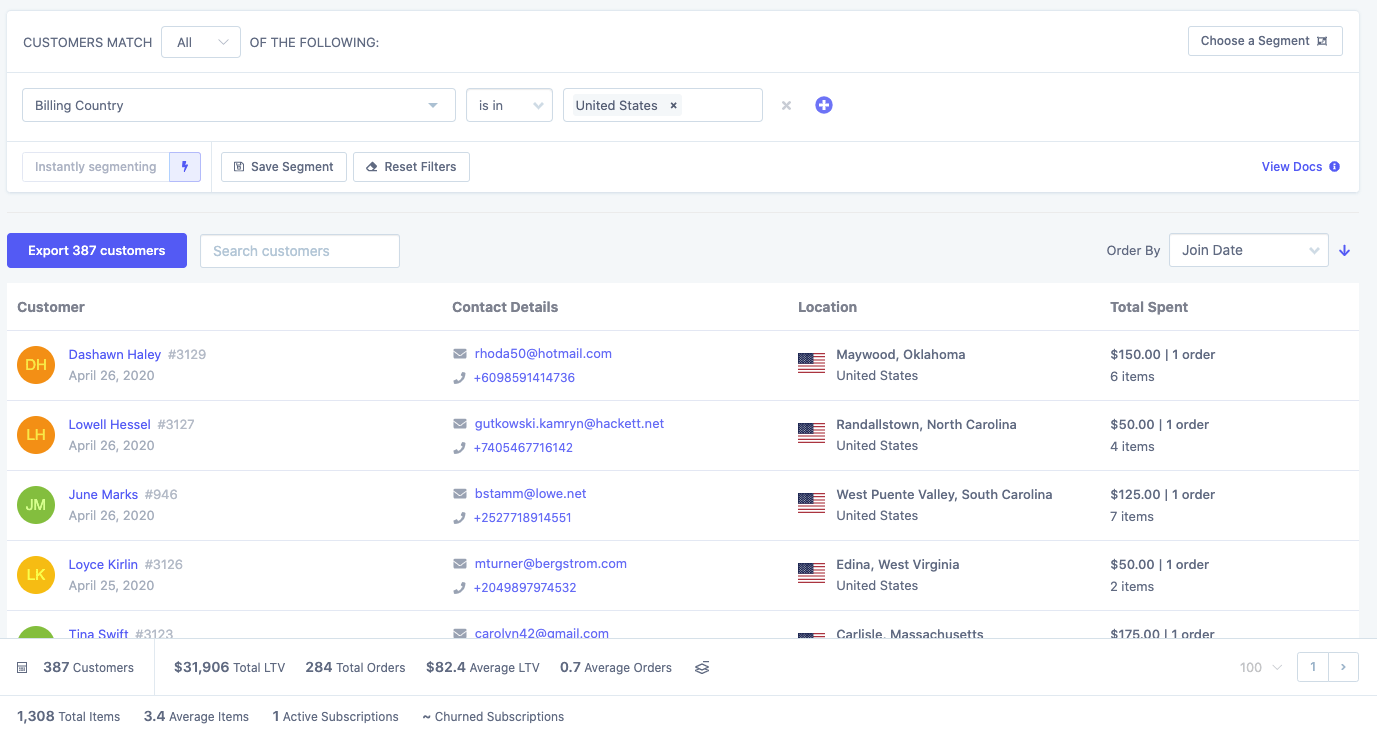

So we know what our LTV is across our entire customer base. But what if we wanted to get more granular with our analysis? What about if we wanted to compare the LTV of Australian customers against the LTV of US customers? This is actually quite simple, you just need to get the total amount of customers from each country, and their respective total revenues. So let's say we have 34 Australian customers with a revenue of $3,090. And 387 USA customers with a total spend of $31,906.

LTV Australian = 3090/34 = $90.9

LTV USA = 31906/387 = $82.4

And in Metorik, you can easily find this by segmenting your customers by billing country:

You can see average LTV for the segment (plus other metrics) in the stats bar at the bottom of the page.

Even deeper

So now with the math out of the way, it's time to look into how you can use LTV to make better business decisions.

Deciding how much to spend on customer acquisition

This is where LTV is most useful. In the above example, we found across our entire customer base, we can expect to earn $124 for every new customer we acquire. Therefore, to make a profit from this new customer, our manufacturing (if it's a physical product) + our operating costs needs to be less than $124. To keep things simple, let's imagine our product costs $50 to manufacture, and we have no other costs. Therefore, we need to spend less than $74 (124 - 50) to acquire a new customer and remain profitable.

We can take this a step further. In the above example, we also calculated that our Australian and US customers have different LTVs. In fact, on first look, we might look at the figures and think we should spend more money acquiring US customers instead of Australian ones, as US customers have a 10x total spend compared to Australian ones ($31,906 v $3,090). However, when we compare the LTV figures, we see than an individual Australian customer earns us an extra ~ $8 in revenue compared to a USA customer (90.9 - 82.4). So the strategy might be, reduce ad spend on US customers, and pump that money in acquiring more Australian customers, as they are more valuable.

Revenue Forecasting

Knowing your LTV with also allow you to better calculate your future revenue. You can look at previous periods to calculate how many new customers you should expect each month. And if you multiply your expected users with your average LTV then you have your expected revenue.

TL;DR

LTV is a metric that will help you better understand the true value a new customer adds to your store. And for extra value, you can segment those customers and derive an LTV per segment.

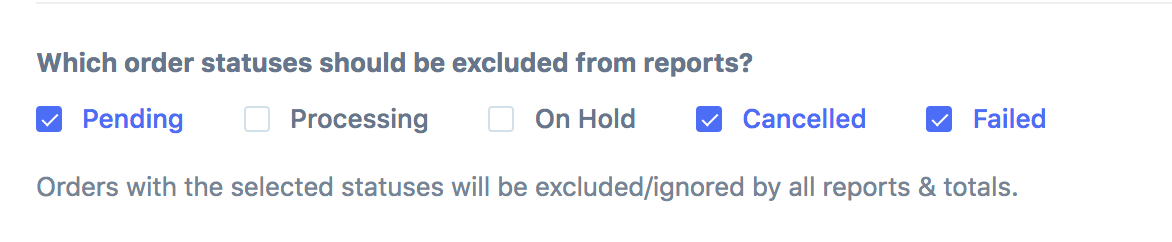

The other important thing to remember when calculating LTV is to exclude orders that were failed, cancelled, or another status you don't recognise revenue from. This is something that Metorik covers, through a report settings to exclude certain order statuses (including custom ones) from totals:

If you're doing the calculation manually, be sure to only use the total amount of revenue received from orders you deem successful.

-1549438730.jpg)