Today we are going to talk about COGS.

And no, not these types of cogs, if you were thinking that:

.jpg)

We are talking about the business type of COGS — one which can better help you understand the profits you are earning from the products you sell. Let’s jump in!

Acronym Overview

Acronym: COGS

Stands for: Cost of Goods Sold

Complexity: Easy

Topline

When evaluating the performance of your business there are a number of different figures that you need to look at.

The first place you should start is at your revenue. Revenue is the lifeblood of any business — if there is no revenue, there is no business. And while it is important, it only tells part of the picture, and can often be misleading.

Let’s look at a simple example. Business X and Business Y manufacture and sell water bottles.

In their first year of operation, both businesses sell 5000 bottles at $20 per bottle — giving them each a total revenue of $100,000 each.

On first thought, you might think that both companies have performed exactly the same for the period. However, we are missing a huge piece of the puzzle — those waterbottles cost money to produce. And it’s that cost which is their COGS (cost of goods sold).

So let’s dig deeper, it costs Business X $5 to produce a bottle as they manufacture overseas, and it costs business Y $10 as they manufacture domestically.

So, therefore, the COGS for each business is:

COGS Business X = 5 x 5,000 = $25,000

COGS Business Y = 10 x 5,000 = $50,000

Ultimately giving each business a gross profit of:

Gross Business X = 100,000 - 25,000 = $75,000

Gross Business Y = 100,000 - 50,000 = $50,000

So we can see that at least at a gross level, Business X has been more successful.

Going deeper

So how you use COGS to help you better operate your eCommerce store?

WooCommerce

By default, WooCommerce only allows you to enter the selling price of your product/service/subscription. This means that when you look at your WooCommerce/Metorik reports, you will only ever be able to determine your revenue. And as we learned above, revenue can be deceiving.

What this also means is that you won’t be able to determine profit within WooCommerce. You would need to export your WooCommerce revenue to your accounting software and then see your profit in your profit and loss report. That’s not an ideal workflow — as especially if you're only exporting this quarterly or even yearly, there will be a lag in determining how profitable your products actually are. So how would you go about integrating your COGS into WooCommerce?

Well, WooCommerce has actually built a COGS extension to allow you to enter your cost for each product you sell. And while this is a good option, it has its shortcomings. For example, you can't set any other costs except for your product costs — for example shipping or transactional costs.

Shopify

Shopify, on the other hand, allows you to enter costs for your products and variations — which is a good first step. But it also suffers from the same issues as the WooCommerce COGS extension — the inability to set any other costs other than product costs. As such, Shopify gives you an idea of your profit, but not very accurately.

Metorik

That's why we built a cost system directly into our eCommerce reporting app, Metorik. Not only does Metorik report on your orders, customers, products, carts, and many other resources — but it also allows you to manage your:

Product and variation costs

Shipping costs

Transactional costs

Other custom costs

And of course, once you have these all set, you can see your profit, margin and total cost at both a store level and an individual store level.

If you have costs already set in WooCommerce or Shopify, you can import these directly into Metorik with the push of one button:

.jpg)

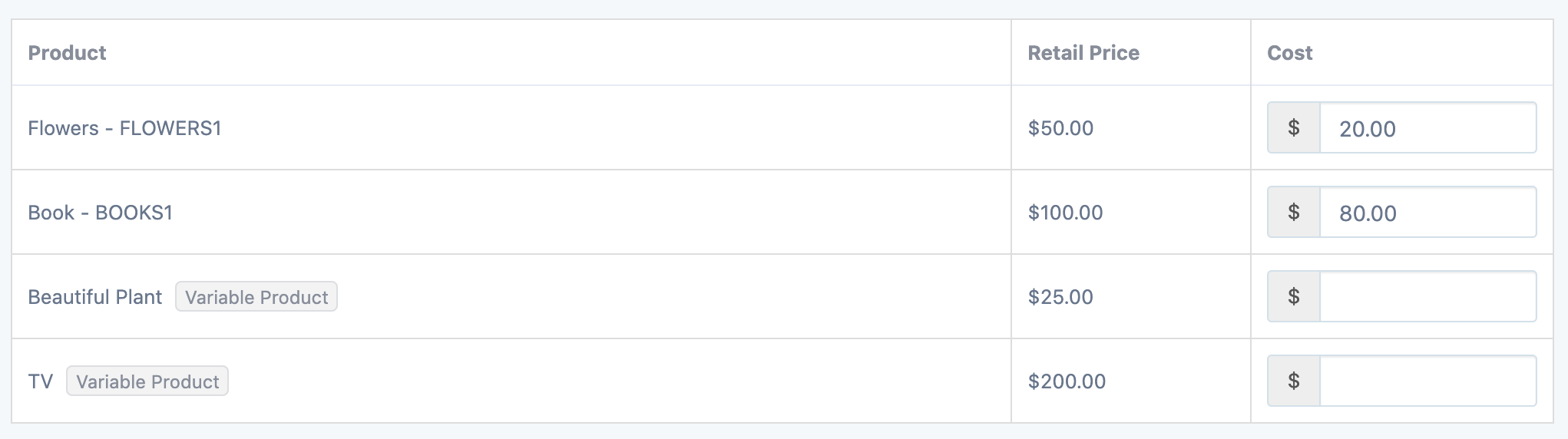

You can also add or edit your costs manually. And even bulk update with a CSV upload:

And as I mentioned above, you can set your shipping costs based off their the country or shipping method:

.jpg)

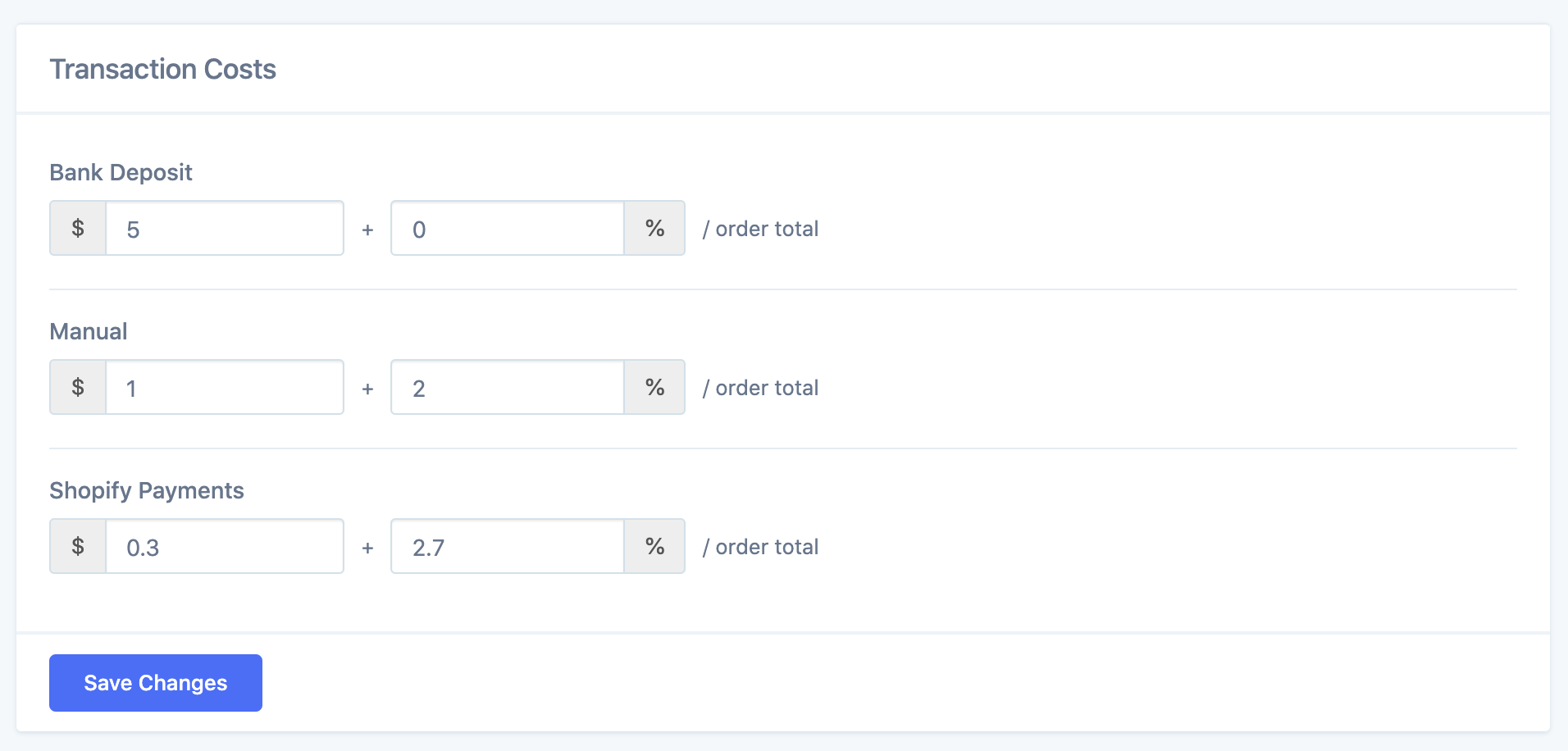

You can set transaction costs:

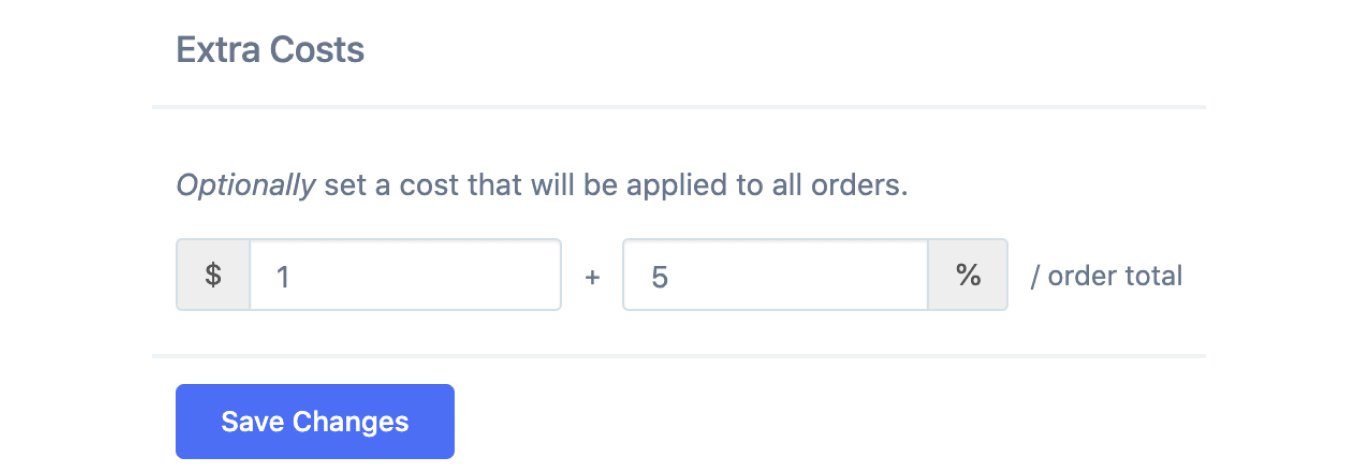

And even set a custom extra cost:

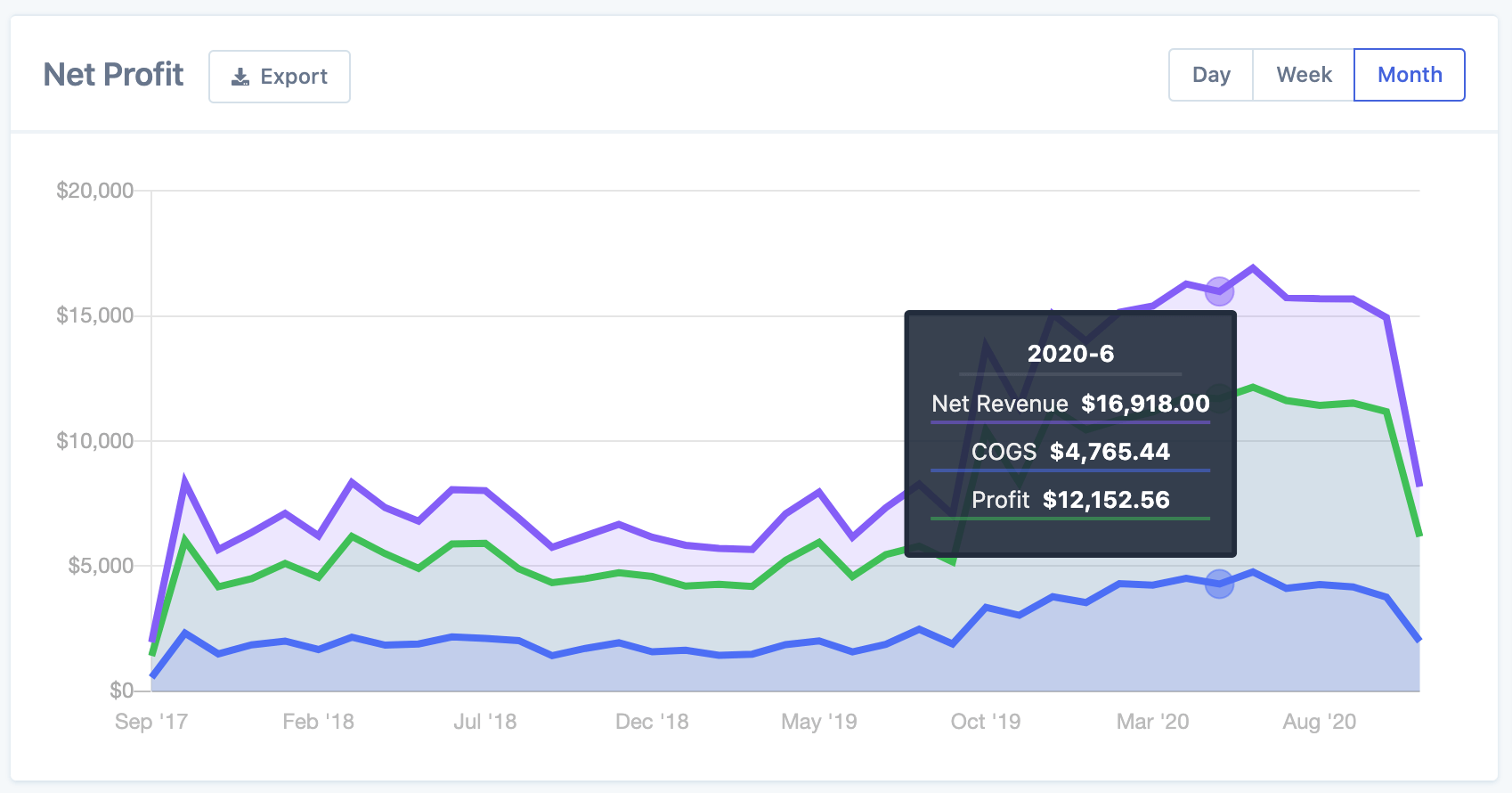

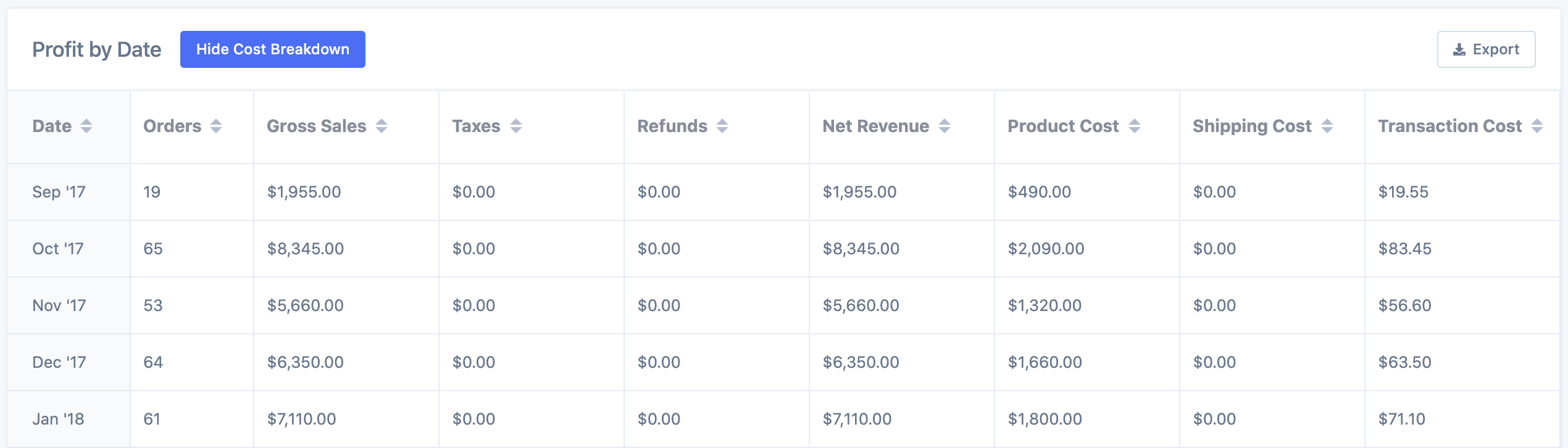

Once you have set these, you will be able to see your profit for any time period in Metorik:

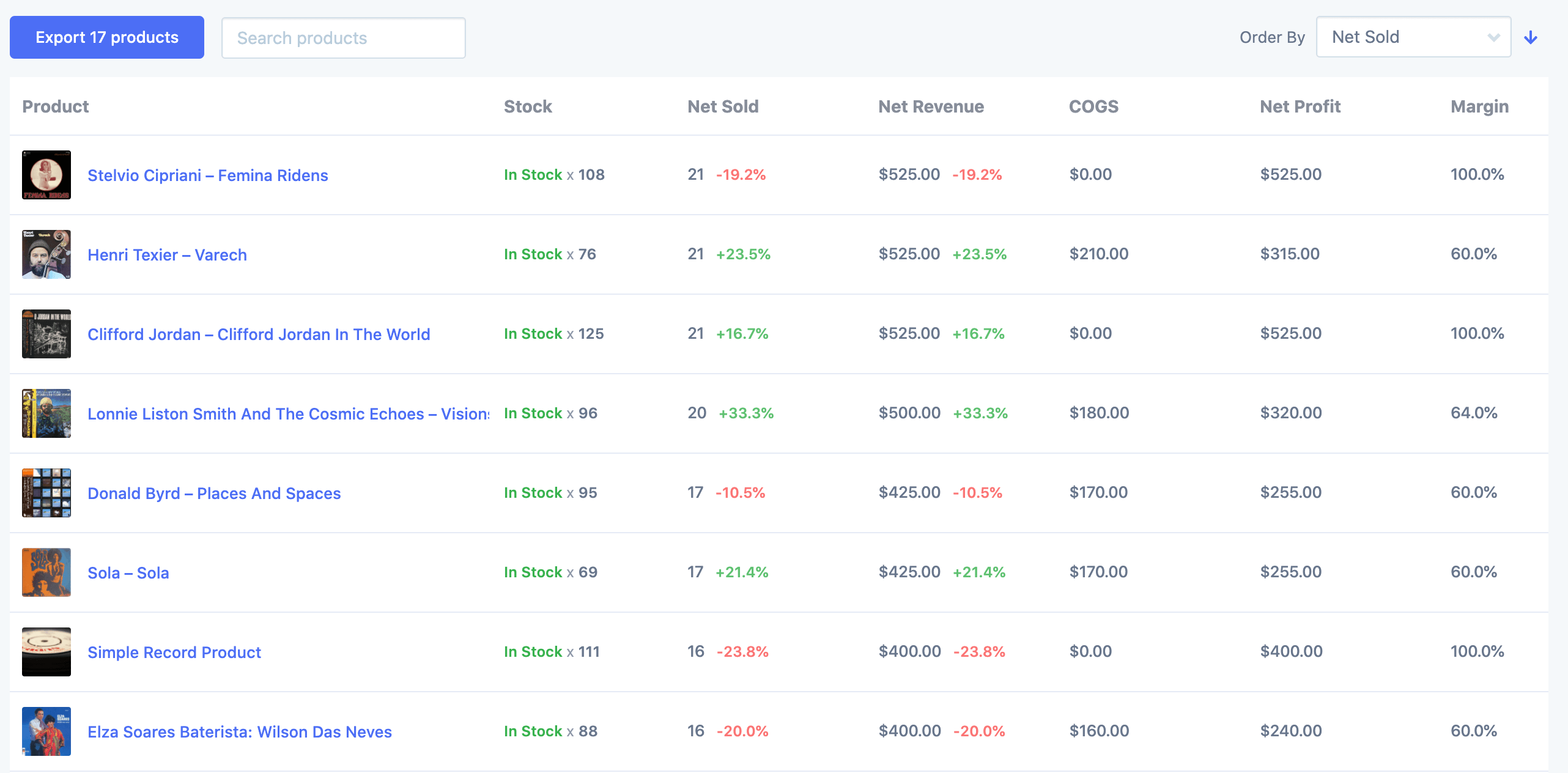

You can also see COGS on a product/variation level:

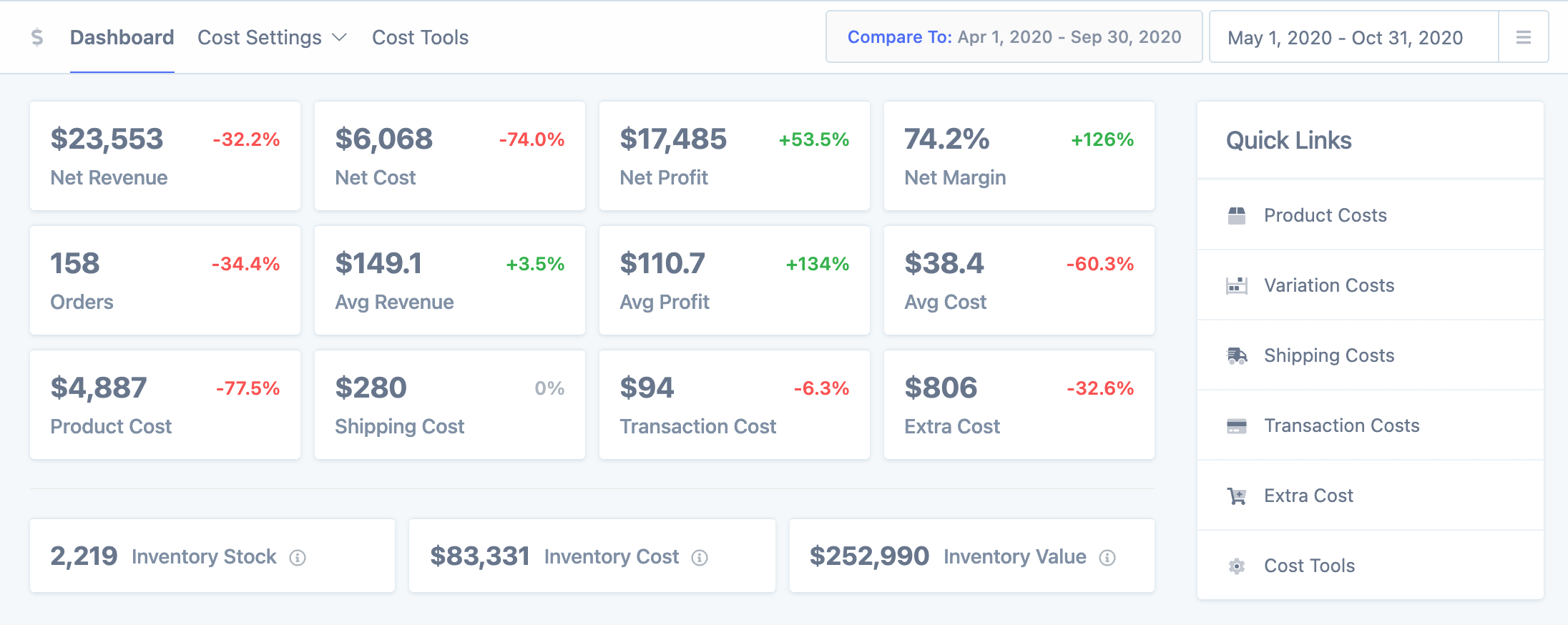

And also see the cost and sale values of your inventory from the cost dashboard:

TL;DR

Integrating your COGS directly into your eCommerce store will allow you to have a much better understanding of the profitability of your products and store.

And while it’s important to look at your revenue, remember that it only tells a part of the overall picture of your business!

-1549438730.jpg)